4 Things to Know About Loan Against Property – Compare Interest Rates

You can use your property to generate funds, repay the loan with interest, and regain possession of your property papers. Because it is a secured loan, the disbursement is quick and easy, with minimal documentation.

A loan against property (LAP) allows you to borrow money from banks and other financial institutions by pledging your property as collateral. You can use your property to generate funds, repay the loan with interest, and regain possession of your property papers. Because it is a secured loan, the disbursement is quick and easy, with minimal documentation.

If your credit score is good and you have not missed or defaulted on previous payments, you can get this loan quickly. These loans are sometimes pre-approved for customers with clean financial records. With a flexible repayment period of up to 20 years or more, you can repay the loan in EMIs with ease. Another advantage of this loan is that you can continue to live in your home as long as you don’t default. The ownership does not change, and when you pay off your loan completely, the lender issues you the property registration papers as well as a NOC.

If you have excess funds, you can also choose to pre-close this loan. If you get a loan with floating rates, you won’t have to pay any pre-closure fees. The interest rates on secured loans are low. Furthermore, your income and good credit score can help you borrow more money at lower interest rates.

One of the most important things to remember before applying for a loan against property is that your property must be legal and free of liens, have all necessary approvals, and you must be the property owner. It is best to keep some important factors in mind before taking out a loan against your property.

Tenure of the Loan

The interest rate is determined by the loan term. The longer the tenure, the more interested you will be. Always try to choose a shorter repayment period.

Your Credit Score

Your credit score is critical in assisting you to borrow at a lower interest rate. If you have a credit score of 750 or higher, you can negotiate favourable interest rates with the bank.

Property Type

The market value of your property determines interest rates and how quickly the bank disburses your loan. It is easier to obtain a loan if your property has been approved by the government.

Borrower’s Profile

Aside from documents and property, the borrower’s age, income, job, and so on all influence the interest rate and help him or her borrow money quickly.

Interest Rates & EMI on Loan Against Property

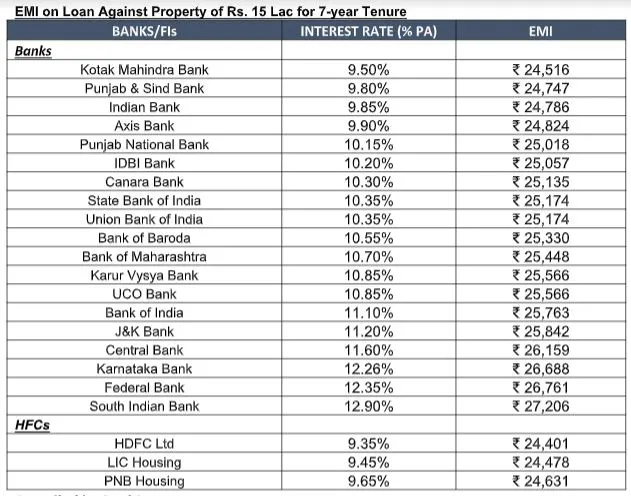

EMI on Loan Against Property of Rs 15 Lakh for 7-year Tenure

Compiled by BankBazaar.com

Note: Interest rate on Loan Against Residential Property (LAP) for all listed (BSE) Public & Pvt Banks considered for data compilation (excluding small finance banks) and including selective HFCs; Banks for which data is not available on their website, are not considered. Data collected from respective bank’s website as on 03 Jan 2022. Banks and HFCs are listed in ascending order in their respective category on the basis of interest rate i.e., bank offering lowest interest rate on LAP is placed at top and highest at the bottom. Lowest interest rate offered by the bank and HFCs on LAP is shown in the table (irrespective of loan amount and tenure). EMI is calculated on the basis of Interest rate mentioned in the table for Rs 15 Lakh Loan with a tenure of 7 years (processing and other charges are assumed to be zero for EMI calculation); Interest mentioned in the table is indicative and it may vary depending on bank’s T&C.